Elevate Your Wealth. Unlock Your Next Chapter.

Whether you’re ready to grow your wealth through strategic real estate investments, or you’re considering selling your multifamily property, Asset Stream Properties offers the expertise, relationships, and precision you need to move forward—on your terms.

At this level, you’re not interested in speculation or extra work. You want real, lasting results—delivered with transparency, expertise, and total alignment.

Asset Stream Properties is the partner of choice for accomplished investors and discerning property owners who expect more:

Exclusive access to off-market deals and institutional-grade investments

Seamless transactions for property owners who want to exit without hassle

Proven execution, strategic insight, and a track record of performance

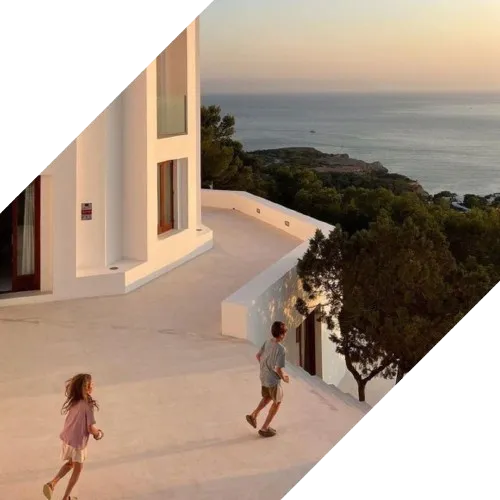

Strategic Real Estate Investments for Elite Wealth Builders

You’ve already built success. Now it’s time to take your capital to the next level—without giving up control or adding another job to your life.

We offer two distinct paths to fit your goals:

Private Portfolio: Maintain ownership and decision-making power alongside an expert operator.

Passive Investments: Grow your wealth quietly in the background, with stable returns and no operational headaches.

Our exclusive, relationship-driven approach brings you off-market opportunities, hands-on execution, and a portfolio that compounds over time.

Watch the Replay: Woody Creek Investor Session

Missed the live walkthrough of our current raise, deal traction, and bonus depreciation mechanics?

The full replay is now available on demand.

Sell Your Multifamily Property, Seamlessly and Securely

You’ve created value. Now, when you’re ready to realize it, you deserve a process that’s efficient, private, and tailored to your needs.

We specialize in buying small to mid-size multifamily properties directly from sophisticated owners, offering:

Confidential, no-obligation consultations

Fair, transparent offers—no broker fees or delays

The ability to close quickly, with respect for your timeline

Whether you’re looking to reposition your capital, simplify your life, or move on to your next venture, Asset Stream is your trusted buyer.

Small is Strong: Why Boutique Multifamily Beats Institutional Assets

The best opportunities aren’t always the biggest ones.

In fact, they’re often the ones most institutional players ignore.

In this free guide, we break down why boutique multifamily is the most compelling space in real estate right now, and how savvy investors are using it to create outsized returns with less competition.

Inside, you’ll discover:

Why “too small” for institutional capital often means “just right” for private investors.

How boutique assets create control, tax efficiency, and repeatable returns.

Real examples of properties achieving infinite return status.

Our Track Record

With over $30M in assets under management and more than 150 doors acquired and operated, our approach is rooted in disciplined execution and aligned interests.

Consistent, above-market returns for our partners

Strategic, value-add acquisitions

Long-term wealth and security—never speculation

Choose Your Next Move—With Confidence

Whether you want to invest in a growing, recession-resistant portfolio, or you’re ready to exit your property with certainty, our mission is the same: to help you unlock the next level of your financial journey—without unnecessary friction.

Join the Asset Stream Network

Be the first to hear about upcoming Deal Room sessions, curated opportunities across asset classes, and

insights from operators we trust. Sign up to stay connected with what’s moving in today’s private markets.

Let’s take the complexity out of your next big move. Connect with Asset Stream Properties for a discreet conversation about your goals—and see what’s possible when you work with a partner who’s as serious about results as you are.