We help home services entrepreneurs transform today’s revenue into long-term wealth for tomorrow.

You Work Hard, But Your Money Could Work Harder for You

At Asset Stream, we’re focused on putting your money to work for you, building long-term, legacy wealth that your family can depend on in the future.

We Know You Work Hard,

But is Your Money Working Hard for You?

Are you frustrated that you’ve invested before with very little return? Business is thriving, but you know you need to diversify your income streams?

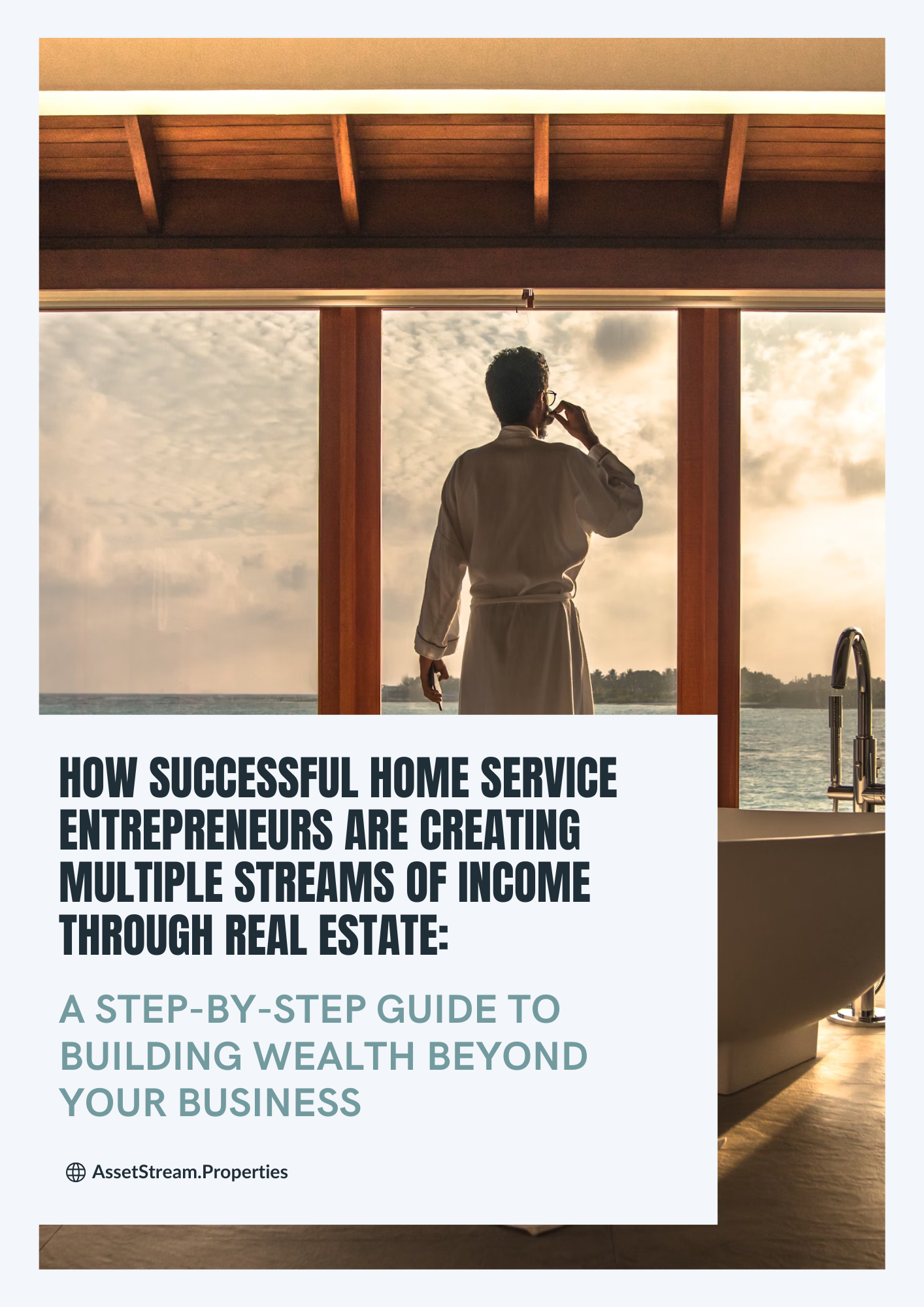

Let us put your money to work for you creating generational wealth that provides freedom and abundance, allowing you to spend more time with the people you love.

Financial Freedom Made Simple with

Smart, Hands-off Real Estate Investments

WIER

CACTUS

SAN MARCOS

GET A STEP-BY-STEP GUIDE TO BUILDING WEALTH BEYOND YOUR BUSINESS

We’re on a mission to create personal freedom and wealth for hardworking business owners.

We know how hard you work as a home services entrepreneurs. We know how it feels to work long hours to provide a life for your family.

We also know how much you miss when you’re glued to your business and we know the very real risk that the money you earn today may not be there for you when you’re older.

Let us show you how you can put today’s revenue to work for you building long-term generational wealth through hassle-free, totally hands-off real estate investing.

Join our Newsletter

Join our inner circle to be the first to know:

New investment opportunities

Timely market updates

industry trends

How It Works

We rigorously research and vet properties to match our strict criteria.

You invest alongside others to become a fractional owner of the property.

We manage every aspect of the property to deliver return on your investment.

READY TO GET STARTED?

What Our Sellers Say

As an investor with Asset Stream Properties, I am never worried at any point and can trust that my investment is being well taken care of. Pete always does what he says he is going to do and keeps people informed.

I have known Pete for years and have seen that he is always on top of things. In the first year of my investment, it is already producing strong returns and the value of the property has gone up significantly. Pete is cautious and analyzes deals with care - he has a gift for seeing what a property could be with small upgrades that make the property significantly more cashflow positive.

What I have appreciated about this journey is that Pete is an expert in what he does, but I always feel like a part of the decision making process without having to be hands on.

Michael Burke

Blogs

Are Bonds Really Zero-Risk Investments?

Are Bonds Really Zero-Risk Investments?

Written by Pete Schnepp

Bonds are often touted as being very low-risk investments. Some would even go so far as to call them risk-free. But is that really the case? All investments come with risks to balance out their rewards, and bonds are no different. Here are a few of the risks you take on when you invest in bonds.

Interest Rate Risks

This is one of the best-known perils of bonds. The relationship between a bond and the interest rates in the market are complicated, but basically, supply and demand are at play in influencing the interest rate on the bond. A bond you invest in might decline in value if interest rates rise. Yikes!

Inflation Risks

A bond is worth a fixed amount of money. If you invest 10,000 dollars in a bond, when it’s paid back to you, you’ll get 10,000 dollars. Seems straightforward and risk-free, right? Nope!

You must remember that inflation is a factor in every economy. 10,000 one year is unlikely to have the same purchasing power five years from the date the bond is issued. In that way, there’s a good chance your bond is going to decline in total value, and that means money out of your pocket.

Default Risk

If you invest in bonds for a corporation, and that company goes under? Who knows what you’ll be getting back. If the bank repossesses the assets of the company you’ve given your money to, well, that’s simply not your money anymore. It’s gone.

Takeaways?

Bonds aren’t the riskiest investment, sure, but they do come with their own set of risks. And that low risk deal that you think you’re getting also tends to come with low value and minimal rewards. Bonds aren’t a terrible investment, but they’re not necessarily the best one.

Real estate, on the other hand, is a great investment choice for anyone who wants to see their wealth grow surely and steadily. No matter what happens, if you invest in real estate, you can rest easy knowing that there’s a solid piece of land behind your money.